Property Through Pension

BCWM can provide financial advisors and their clients with self-directed pension options: ARF, PRSA, SSAP or BOB, that will allow them to invest directly in real estate and other investments on the basis of best advice.

- ARF, an Approved Retirement Fund for post-retirement

- SSAP, a Small Self-Administered Pension Scheme

- BOB, a Buy Out Bond, suitable for consolidating different pension scheme types.

- PRSA, Personal Retirement Savings Account.

What are the advantages of holding Real Estate in your pension?

- Tax relief on pension contributions to a pension scheme

- No income tax on rental payments received to the pension scheme

- No capital gains tax on the disposal of a property in a pension scheme

- Borrowing may be available

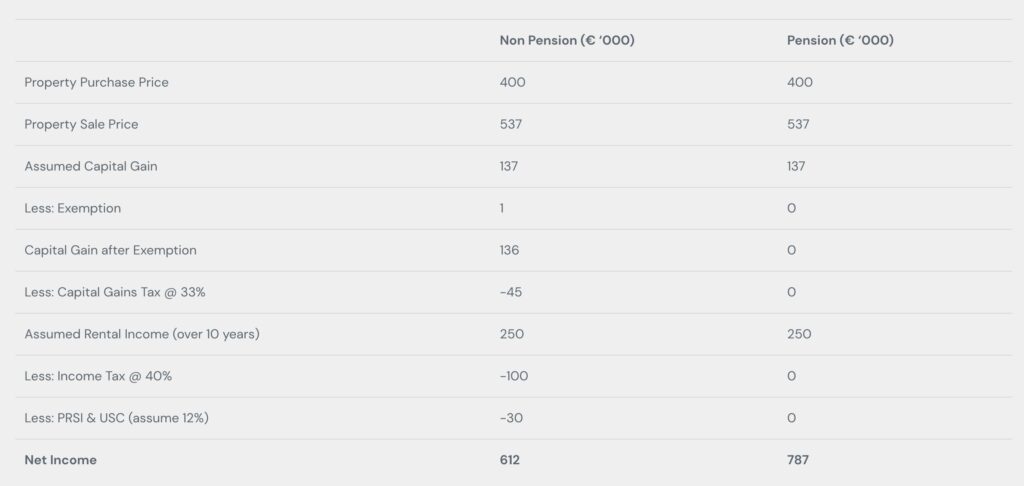

The difference in potential investment return received over 10 years to the pension compared to a private investor excluding the cost of property management expenses and pension providers fees is €176,248.

SAMPLE CALCULATION

| Non Pension (€ ‘000) | Pension (€ ‘000) | |

| Property Purchase Price | 400 | 400 |

| Property Sale Price | 537 | 537 |

| Assumed Capital Gain | 137 | 137 |

| Less: Exemption | 1 | 0 |

| Capital Gain after Exemption | 136 | 0 |

| Less: Capital Gains Tax @ 33% | -45 | 0 |

| Assumed Rental Income (over 10 years) | 250 | 250 |

| Less: Income Tax @ 40% | -100 | 0 |

| Less: PRSI & USC (assume 12%) | -30 | 0 |

| Net Income | 612 | 787 |

In the example above we have assumed a property purchase price of €400,000, a 3% per annum capital gain in the value of the property, €25,000 per annum rental income and a hold period for the investment of 10 years.

Contact Killian Conroy on 01 906 0250 or killian.conroy@bcwm.ie. We would be pleased to explain the details of the options available to you.

BCWM plc is regulated by the Central Bank of Ireland.

Warning: Please note that investment in property and certain pension schemes used to facilitate such investments are not regulated products or services and do not require licencing, authorisation or registration with the Central Bank of Ireland. As a result, they are not covered by the Central Bank of Ireland’s requirements designed to protect consumers by a statutory compensation scheme, nor are they covered by the requirements of the Investment Firms Regulations relating to the protection of client assets.

Warning: The figures shown in the example above are indicative only and are subject to change.

Warning: You may get back less than you invest.

Warning: Investors are advised to get their own tax advice.

Warning: If you invest in this product you may lose some or all of the money you invest.

Warning: The value and income from your investment may go down as well as up.

Warning: Past performance is not a reliable guide to future performance.

Warning: If you invest in this product you will not have any access to your money until you retire.

OUR PEOPLE

Deep expertise and experience - integrated to serve the client

For over a decade, the firm’s management team has continued to develop its skills and practices such that we believe we now have an unparalleled depth of expertise and experience.

BCWM PLC

13 Upper Mount Street

Dublin, D02 F407, Ireland

BCWM SARL

10 Rue des Capucins, L-1313

Grand Duchy of Luxembourg

-

-

PRIVACY POLICYPRIVACY POLICY

-

POLICIES & DOCUMENTSPOLICIES & DOCUMENTS

-

COOKIE POLICYCOOKIE POLICY

© BCWM. All Rights Reserved. BCWM plc is regulated by the Central Bank of Ireland

Website by www.create.ie